Employees Provident Fund has considered interest of contributors rather than profit, claims Administrator Dhital

Kathmandu: The Employees Provident Fund (EPF) established for the welfare of all government employees has completed over six decades’ journey. This institution has provided significant contributions to the overall service of employees and to the social security sector as well by mobilizing funds equivalent to Rs 500 billion.

EPF has also established itself as a leading institution investing in Nepal’s infrastructure development sector, especially in the hydropower projects. It is in final preparation for the construction of the Betan Karnali Hydroelectricity Project through its subsidiary company. EPF has invested Rs 22 billion in the purchase of aircraft for the national flag carrier, Nepal Airlines Corporation. Rastriya Samachar Samiti (RSS) reporter Ramesh Lamsal had a tete-a’-tete with EPF Administrator Jitendra Dhital on a range of topics including the EPF’s upcoming activities. Here are the excerpts from the interview:

Q. What activities has the EPF been carrying out in recent days?

A. The Employees Provident Fund is a leading institution of the country. Since it is an entity with a history of over six decades, it has won the trust of the contributors. We have emphasized strengthening and modernizing the organisation in recent days. Many works have been carried out to that end. We have fully digitalized the institution that had started and worked for many years with paper files. We have moved ahead to work on internal reforms to provide easy and smooth services to our members and contributors. We have carried out reforms in the system.

Now we are an institution with Rs 500 billion-plus capital. We have been working on what new schemes and facilities can be provided to the contributors by mobilizing this source to enhance the institution’s portfolio and credibility. We are working steadfastly to make the fund mobilization more and more secure and systematic. We have also carried out internal reforms in its entirety. We have facilitated in the policy, regulation, guidelines and other works as well.

Q. Topics like internal strengthening are purely internal ones, but the topic of the kind of services the contributors are getting from the EPF is important. What in your view, has the EPF been doing new and special in this regard?

A. Most of our policies and schemes are in the interest of the contributors. We sustain by mobilizing their money. Banks and financial institutions focus only on profit. However, we are working focussing on the contributors’ interests and welfare rather than on profit. We mobilize amounts equivalent to more than 90 per cent of our earnings and profit for the welfare of the contributors. So, rather than the EPF’s profits, we take an interest in the contributors and have been doing exactly that.

In the recent days, we have concentrated on especially two kinds of facilities. We have been looking from the perspective of whether some financial support can be provided to the contributors when they are still in service. We have also been providing support accordingly. We have been issuing loans to the contributors easily and in a convenient way. Of late, the interest on the loans that we provide is less than the interest on the deposits of the contributors. We have provided higher interest. This has become possible also because we have a huge fund. Systematic mobilization of the funds and institutional good governance are also the reasons behind the EPF being able to provide bonuses to many.

We provide bonuses even after the depositors are retired from their jobs. We have been operating the contribution-based provident fund in accordance with the responsibility entrusted by the Government of Nepal. We have been conducting studies in partnership with international agencies as to how the non-contributors can be provided with services. Under the social security programme, we have supported the contributors in terms of compensation for accident, medical treatment and their dependent family of even after death. We have financially assisted the women employees during their post-partum. The male employees too have benefited from this. The restitution programme for medicines and medical treatment has been moved forward. We have been providing one million rupees in case of chronic disease and Rs 100 thousand in case of hospitalization. We have implemented this programme even benefiting the contributor’s wife as well as per the request of the government. We have the goal of extending this facility to all members of the contributor’s family in the coming days.

EPF is focused on works as providing social security to the contributors and facilitating health and education. Insurance companies have their own kind of principles, but we have provided the treatment expenses even if the treatment is done in the health facilities registered with the government across the whole of Nepal. We have run this scheme in a comprehensive way. Our goal is to give whatever is possible to the maximum extent to the contributors. A programme already implemented cannot be retracted. Therefore, we have carried out adequate homework and study before implementing and making any programme public.

We certainly could have intervened in the context of the interest. We should move ahead collaborating with the State bodies related to this. We are also not outside the existing financial system. Nepal Rastra Bank (NRB) is there to regulate the banking system. The Ministry of Finance is also there. Rather than us going alone, we have been playing a role in determining the liquidity, and interest rate through collaboration with these bodies.

We could have played a role as a big institutional depositor in the context of increasing or decreasing the interest rate. However, we collaborated with NRB and the Ministry of Finance on this and accordingly played our role. We should be seen from a different perspective. However, we are also placed in the same basket as other BFIs are kept. Because we have so big role in the State’s financial system, we feel that we should be seen from a slightly different perspective. However, generally it is not like that. We too have grudges over this.

We have our reservations over the recent provision of giving two per cent less interest to the institutional depositors. Why? Because this itself is our investment. The rest of the institutions are set up for other purposes or what they do is they only take the interest by keeping the money they have brought for a specified purpose in fixed deposit and not mobilizing it for the specific purpose it was meant for. Our contention is that EPF should not be compared to such institutions. We also raised this issue formally and informally. We cannot work going beyond the mandate of the State and this is known to all.

Q. The EPF has investments also in big commercial banks in Group A as well as institutional deposits. Because of this, you are criticised for not doing what you ought to be doing. There could be intervention in the market had you done so. Don’t you think you have not paid attention to this aspect?

A. We are an institution under the Government of Nepal, Ministry of Finance. Nepal Rastra Bank regulates the banks and financial institutions, which you already know. It is true that we have not been able to work in controlling the interest rate as profit-oriented banks and institutions fulfilling social responsibility are seen through the same lens. We are not alone in this. There are also institutions like the Citizen Investment Trust (CIT) and the Beema Sansthan (Insurance Corporation), the Social Security Fund (SSF).

These institutions alone are the institutional depositors. These institutions could have taken the initiative to influence the interest rate. Generally, it looks like a free market, but looking at it substantially, there is a monopoly somewhere. A two per cent decrease in interest rate in like institutions means the impact is quite different. Banks and financial institutions are benefited from this. The deposit from here goes there. Our bank and financial institution has a fund of Rs 130 billion. The money of the CIT and SSF is to the tune of this amount, but the situation is that our money goes to the banks and others get the benefit from this.

Q. The trend of withdrawing one’s deposit with the EPF and keeping it in banks and financial institutions for more interest has seen a sudden spurt in recent days. There was this talk in the meantime that a kind of mechanism is needed to stop this. Is there any progress on this?

A. The topic of the growing trend of withdrawing money from the EPF and keeping it in banks and financial institutions is very true. There is a profit of up to four per cent when money is borrowed as a loan from EPF and kept in banks and financial institutions. There was this instance in which Rs 500 million was withdrawn on a single day. This process continued for two to three months. Capital formation could not take place when the money deposited for the retirement fund was withdrawn in this manner. Money withdrawn this way was spent on daily consumption as well. Only a small amount of money was deposited in BFIs as well. This was also behind the liquidity shortage. One should not think of reaping profit by withdrawing the money deposited in the EPF and keeping it in private BFIs. We reported this to the Ministry of Finance. A study was also conducted. We informed the Central Bank as well.

Q. Generally, EPF determines the interest rate for the contributors after the start of the new fiscal year. What are the EPF’s provisions for the current fiscal year?

A. We have already fixed the interest rate. We determine the interest rate for both the deposits and lending at the beginning of the fiscal year itself. We have made this public now. We have reduced the interest rate. We have reduced the interest rate for both deposits and loans by 0.5 per cent. We provide 7.5 per cent interest to the contributors (depositors). We add one per cent in the end. Overall, this comes to 8.5 per cent. We have set a spread rate of an additional one per cent on lending.

Q. EPF is a large institution lending to big physical infrastructures of Nepal, especially to the hydropower sector. How risky is the investment in this sector? How do you assess?

A. EPF remains as the institution making the largest investment institutionally in Nepal’s energy sector. This is a matter of pride for us. In the beginning, we invested in the Chilime Hydropower Project. Similarly, we have invested Rs 22 billion in Tamakoshi. Our investment increased as the cost of the project went up. The Upper Tamakoshi started to regularly pay instalments from Chait (mid-March to mid-April) last year. It will pay back within 15 years. The next project of Chilime is also in the final phase of completion. We are the biggest institution in terms of investment in the infrastructure sector. We have invested nearly Rs 73 billion in this sector. Recently, EPF has signed an investment agreement for Tamakoshi Fifth as well. The Upper Tamakoshi has paid installments equivalent to Rs 3.2 billion so far.

We have invested in nearly 800-megawatts capacity projects. We are also keen on investing in big projects like Upper Arun and Budhigandaki. Discussions are on regarding this.

EPF is making final preparations for itself to construct the 429-megawatts capacity Betan Karnali Hydropower Project. There is a complication in the construction of transmission lines for projects we have invested in. We are concerned about whether the electricity generated from these projects is not going to sell. Therefore, discussions have been held with the Board of Directors on whether some re-evaluation is required.

Q. EPF has invested in Nepal Airlines Corporation (NAC) also. There is this talk from time to time that the NAC has not paid the instalment of the loans provided to it for purchasing aircraft. What is the situation? Is it that bad?

A. We have financing for three of the four aircraft with the NAC. We have invested around Rs 22 billion. This loan has increased and reached about Rs 29 billion. It could not pay the loan due to the COVID-19 pandemic. NAC has paid a loan to us three times in the recent period. NAC’s liability is constantly increasing. When we discussed it with them, they said they cannot pay. On the other hand, they are preparing to procure new aircraft. This is quite contradictory. NAC needs aircraft to drive it ahead. Transparency is necessary for NAC. We feel that they are not giving interest to paying back the loan may be because the government is the guarantor. I am amazed by the way they are publicizing in recent days that they have paid the loans. They have not regularly paid the full instalments to us whereas they are on a publicity stunt that they have paid them. It is also said the process for purchasing new aircraft has been forwarded. This is self-contradictory. The profit that our contributors would otherwise get has been affected due to the ‘provisioning’ of our loan. Although we have consistently taken initiatives, NAC has not been able to demonstrate transparency. This is the reality.

Q. Are you going to go ahead with the process in case NAC approaches EPF asking for a loan again in the process of purchasing new aircraft?

A. I do not think NAC will morally come asking for loans in its present status, and I presume the Government of Nepal will also not tell us to provide loans. We will not be able to provide loans to NAC in its present operation status. I do not see any possibility of it. They had done quite well in the beginning. We provided loans again for purchasing a wide-body aeroplane for the second time, considering the need of the government. I repeat here, There is no transparency in NAC. The Office of the Auditor General is raising questions on this matter from time to time. So, additional loans cannot be given now.

Q. There is no progress in the Betan Karnali Hydropower Project in terms of the goal with which EPF started this project. The Chairman of the Company resigned from his post and the Chief Executive Officer quit citing domestic reasons. In all, the Project is without leadership. Now, how are you going to take charge and move the Project ahead?

A. The facilities in the form of cash that we provide to the contributors are inadequate. we established this Company in 2017 with the objective of advancing the facilities in a qualitative manner. The Project is ready to go for construction situation. The Chair and CEO resigned. We have been discussing this Company and Project with the Board of Directors. Short-term discussions will not do. We are looking for a person who can work in a sustainable way to move the Project ahead with the long-term vision. We are holding consultations among the stakeholders. The Board of Directors has got full shape now and we are searching for CEO.

Q. What would be your response if a lay contributor asks you when he/she will get returns from the investments made so far in the Betan Karnali Hydropower Project?

A. Investment made in the hydropower sector does not give returns immediately. A study has to be carried out in the first phase for this. Technical preparations have to be made. We emphasized in the study that the Project should be completed in the stipulated time and investment. A road has reached the project site till date. Preparatory works are being done. Task-related to the distribution of compensation is in the starting phase. We are preparing to immediately go for construction. Preparations have been made to start the project’s construction by the end of the current fiscal year itself as far as possible. However, lately, the problem has been due to the Chairman and the CEO. I accept this. From now on there will be no problem with this. All the documents have been readied for appointing the contractor and the consultant. We will take the Project to a certain status by the end of the current fiscal year.

Q. What new programmes is EPF bringing for the benefit of all its contributors?

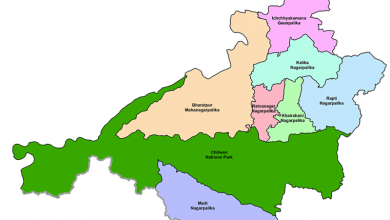

A. We have moved ahead with a new type of loan programme. Programmes like home loans, and educational loans are in implementation in 32 districts only. We are thinking of expanding this to other districts. We have moved ahead with a housing programme through an EPF’s subsidiary company. We have envisaged constructing 129 houses in Bharatpur and providing them to the employees. We are trying to pursue the housing plan by collaborating with the Government of Nepal and the local government. A task force formed under the convenorship of former Chief Secretary Leelamani Poudyal has also included the topic of addressing the housing issue. It has been recommended that EPF go ahead in this way as housing for the employees. We ourselves cannot purchase the land for this. The local government should support in its facilitation. Works can be moved ahead in case land pooling is done. We have tried to develop this as a pilot project. We have tried to carry out work in Bhaluwang, the capital of Lumbini Province. Attempts have been made to operate a housing scheme required for the employees there.

Q. The investment made in house and land is taken as an unproductive investment. A question may arise as to why an institution like the EPF is keen on investing in such a sector. What is your answer to this?

A. We are not trying to buy and sell in a commercial way. We will build apartment blocks on the land plot the government provides. Employees live in these apartments. Arrangements would be made for deducting the amount from the employee’s salary (for the housing) in the same way the provident fund is deducted from the employee’s salary at present. They get to live in the housing as long as they are employees. After retirement also, they can take it. Some legal provisions would be made for this. In Singapore, the employees are provided housing in this model. Singapore Provident Fund has provided housing to more than 80 percent of employees there. We too have tried to provide housing in a systematic way by studying this very model. EPF itself cannot do this project. All stakeholders should work together. Some local levels have shown their interest.

Q. Lastly, have you anything more to say?

A. The situation is such that EPF has not been able to fully and in a systematic manner take the works and activities it has been carrying out to the general contributors. Not all the contributors are technology-friendly. They have not known all the work and activities EPF has been carrying out. In such a situation, I would like to thank RSS for giving me this opportunity to address the gap in the communication between EPF’s entire activities and the contributors.

Comments